Taxation – Temporary Differences

December 17, 2020

What are Temporary Differences?

Temporary differences arise when the treatment of an income statement line item is the same for both tax and accounting purposes, but the timing of this treatment is different. These are different from permanent differences where the tax accounting treatment in fundamentally different to its treated in the financial statements.

The income statement is driven by the matching principle of accrual accounting. This means that expenses are matched to the accounting period where associated income is earned, as opposed to when cash is paid or received.

Tax accounting, on the other hand, generally includes items on a cash basis. If an estimate expense is included in the income statement, correctly under accounting rules, the tax authorities may be more likely to only allow a deduction for the expense in calculating taxable profits when the cash payment is actually made.. This reduces the uncertainty regarding the amount of the expense.

The arising difference between the tax expense and taxes paid will reverse in the future, since the expense will be shown in both the income statement and tax account eventually, but not in the same time period. This difference is dealt with by the use a deferred tax item on the balance sheet.

Key Learning Points

- Temporary differences arise when the treatment of an income statement line item is the same for both tax and accounting purposes, but the timing of this treatment is different

- Current taxes are those reported on the current or prior periods tax returns

- Deferred tax is the tax on temporary differences, which result in a variation between the income statement expense and the tax to be paid

- Depending on the situation, this might result in a deferred tax asset (DTA) or a deferred tax liability (DTL)

- DTAs are like prepaid taxes, which are shown on the assets side of a company’s balance sheet. DTLs are like accrued taxes, which are shown on the liabilities side of a company’s balance sheet

Deferred Tax Assets & Liabilities

Deferred tax is the tax on temporary differences, which result in a variation between the income statement expense and the tax to be paid. Depending on the situation, this might result in a deferred tax asset (DTA) or a deferred tax liability (DTL).

Deferred Tax Assets

DTAs can be thought of as a prepayment of tax, which are shown on the assets side of a company’s balance sheet. For example, if we assume a company has an accounting depreciation expense of 100.0 in a year., this amount will appear in the company’s income statement. Let’s also assume that the tax authority only allows for a deduction of 40.0 for depreciation.

This means the taxable profits (as calculated following the tax rules) will be higher than the profit before tax (from the income statement) by 60.0 since the depreciation deduction in the tax calculation is 60.0 lower. As a result, the company’s cash taxes paid (deduction from assets) will be higher than the tax expense on the income statement (deduction from retained earnings). Without any further adjustment, the balance sheet would be out of balance. To solve for this imbalance a deferred tax asset will need to be created. The rationale for this being an asset is that this timing difference will provide a future economic benefit to the company, since it will have to pay less tax in cash in the future when the additional 60.0 depreciation is shown in the tax calculations (but won’t be included within the income statement). The company pays more today, but it can enjoy the benefit of this later by paying lesser cash taxes in the future, compared to what is shown in the income statement tax expense.

Deferred Tax Liabilities

DTLs are similar to accrued taxes, and are shown on the liabilities side of a company’s balance sheet. If the cash taxes paid are less than the tax expense in the income statement (as shown in the example below), the company will need to create a deferred tax liability, since more cash will need to be paid out in the future, in comparison to the tax expense shown in the future. While DTLs represent a future obligation for the business they can be beneficial due to the time value of money benefit of “delayed” cash tax payments. This impact can be economically significant for some sectors for example.

The deferred tax asset or liability categorization is made at the start of the life of the transaction. While its magnitude may change over time, the DTA or DTL will eventually become zero once the timing difference is resolved.

Calculating Temporary Differences & Deferred Tax Liabilities

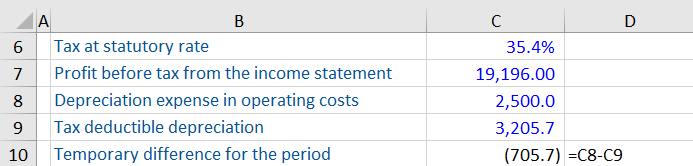

Here is some tax-related information about a company. We have been asked to calculate the temporary differences and the deferred tax liability for the period.

The company’s depreciation expense in its income statement, calculated using its own accounting policy, is 2,500. However, the depreciation expense allowable by tax authorities is 3,205.7. This leads to a temporary difference of 705.7 for the period.

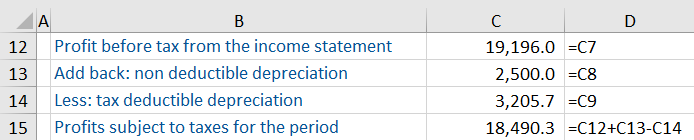

In order to calculate the deferred tax balance sheet amount, we need to calculate the profit subject to taxes following the tax authority rules. We do this by adding the non-deductible depreciation to the profit before tax from the income statement to remove its effect and subtracting the tax-deductible depreciation instead.

Based on this calculation, the profit subject to taxes for the period are 18,490.3. Using this information, we can calculate the deferred tax amount, which is the difference between the tax expense (as per the accounting policy) and the tax due at the statutory rate for the period. This will be a deferred tax liability, since the profit before tax in the income statement is higher than the profits subject to taxes (under the tax authority rules), means less tax will be paid in cash than is shown as an expense in the income statement. As such, more tax will need to be paid in cash in the future.

Here the cash taxes paid (row 17) are lower than the tax expense in the income statement (row 18). This results in a deferred tax liability of 249.8.

The tax expense of 6,795.4 will reduce the company’s retained earnings for the period. The taxes payable to the tax authority will either be shown as a reduction of cash, or more likely since this amount won’t have been paid to the tax authorities by the year end, an increase of taxes payable of 6,545.6, which will be shown as a liability. Finally, deferred taxes of 249.8 will also be shown as a liability, ensuring the balance sheet balances.

The DTL results from the temporary difference, however the taxes payable liability (also referred to as ‘accrued taxes on income’) is money that is owed to the tax authority.

Example: Temporary Differences & DTAs/DTLs

Here are some extracts from the 2018 annual report of Johnson & Johnson, Inc. The company has reported deferred taxes on income both on the assets and liabilities side of its balance sheet. There is both a DTA and DTL since the reasons for these balances will be due to different temporary differences, which are not allowed to be offset. On the liabilities side, they have also reported accrued taxes on income.

Johnson & Johnson – Extract from Footnote 8 (Income taxes), Annual report 2018