Income Taxes

October 30, 2020

What is Income Tax?

Income tax is the amount of tax a company is liable to pay to its local government (depending on where it is based). It can be broken down into three parts: tax expense, tax payable and tax paid. All reference income tax but relate to different financial statements depending on whether the tax has been paid and what accounting period it relates to. Tax is nearly always seen as an operating cost as it relates to an expense arising from the operating activities of the business. It will be accounted for as a current liability if due within a 12 month period.

| Where is it reported? | Detail | |

| Tax expense | Income Statement | It is an expense on reported profits for the period based on the matching principle |

| Tax payable | Balance Sheet | The reported tax account balance owed to authorities paid in arrears |

| Tax paid | Cash Flow Statement | The tax paid in the current accounting period |

Many companies have operations in different countries which results in their income incurring tax laws from various jurisdictions. The effective tax rate reflects the tax benefits of having these operations outside their home country which may be taxed at lower or higher rates.

Key Learning Points

- Income tax is the amount of tax a company is liable to pay to its local government

- Income tax is an expense on profits earned for a specific accounting period

- Tax expense is reported in the income statement and is based on the matching principle as tax is a proportion of profits for a particular period

- Tax payable represents the actual tax to be paid for the current period and is reported in the balance sheet

- Tax paid is the amount of actual cash paid to the authorities and is reported in the cash flow statement

Tax Expense

Tax expense is always found on the income statement and is the total tax payable on a company’s profits for the given period. This item is made up of all the taxes deferred from the prior period as well as cash taxes. The tax expense is based on the matching principle as tax is a proportion of profits for a particular period.

Nike Inc – Extract from Income Statement, 2018

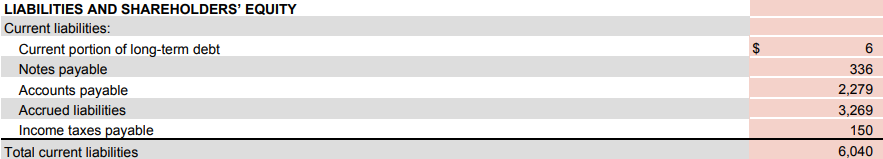

Taxes Payable

The next item is tax payable, which reflects the actual tax cash to be paid during the period. This item will be recognized as a liability on the company’s balance sheet until it has been paid (cash down/liability down). Companies will pay tax in advance or in arrears depending on the jurisdiction.

Nike Inc – Extract from Balance Sheet, 2018

Taxes Paid

The last item is the tax paid. This item is found in the cash flow statement as it refers to the actual cash paid during the period. It can be assumed for many cases that the tax paid will be the tax payable from the prior accounting period.

Nike Inc – Extract from Cash Flow Statement, 2018

How do these Items Relate in the Financial Statements?

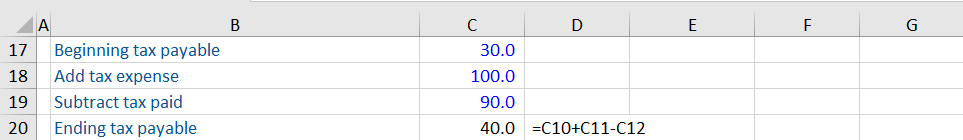

As discussed, all of these items are related and all fall below income statement. Let’s look at a BASE analysis to better illustrate the links between these three items:

| B | Beginning | Tax payable beginning balance |

| A | Addition (+) | Tax expense |

| S | Subtraction (-) | Tax paid |

| E | Ending | Tax payable ending balance |

Tax payable is the amount a company owes to the tax authorities, so we can think of this figure as being the beginning amount for tax owed. Throughout the year, a company is going to be making sales and, hence, generating revenue. If they manage to generate a profit then they will have to pay a proportion of that profit amount in the form of tax expense. By the end of that same accounting year, the company will pay the tax owed so they don’t incur any penalties. This tax paid is the cash transaction and will reduce the total amount of tax to be paid. Finally, after both of these additions and subtractions, the company will arrive at its ending figure of tax payable. This figure will remain as a current liability on the company’s balance sheet.

Example

Bambi Inc estimates the tax expense for the year (still unpaid) as 100.0 at the end of year end. How is this reflected in the balance sheet?

The tax expense estimate of 100.0 was correct. Bambi Inc pays 90.0 to the tax authority at the year end. How is this reflected in the balance sheet?

The balance of Bambi Inc’s tax payable at the beginning of the period was 30.0. Calculate the ending balance after the transactions above.

Taxes and Modeling

An analyst will want to build models and forecast company information for cash flow and valuation purposes. Generally, the focus will be on forecasting the tax expense. From a pure cash flow analysis, especially in a credit context, we will assess tax paid and tax payable as it allows us to analyze historical cash flow and forecast the impact on future cash flow.

For a relatively stable company, we normally do not forecast the changes in deferred taxes as the overall tax paid will equal the tax expense, and as companies maintain their fixed assets (Capex), deferred taxes will be created each year and some released as a result of prior Capex. Therefore, we expect a certain steady level of deferred taxes.