Working Capital Cycle – Day Ratios

October 23, 2020

What are Day Ratios?

Day calculations or ratios are measures of efficiency and provide an insight into how long cash is tied up for in a business. The calculations are based on three key components of the day-to-day operations of a business: inventories, receivables and payables. These items are analyzed by calculating them as a percentage of sales and cost of goods sold respectively.

Key Learning Points

- The working capital cycle measures how efficiently a business is able to convert its working capital into revenue. The calculation includes recievables days, inventory days and payable days

- Receivable days is always calculated relative to sales as accounts receivables represents money that customers owe for products or services rendered

- Inventory days and payable days are always calculated relative to Cost of Goods Sold (COGS)

- The calculation is expressed in days rather than monetary amounts and provides very similar insight into operating working capital (OWC)

Formulas

Receivable Days = (Ending Receivables / Sales) * Number of days of sales

Many companies provide a credit period on sale and receivable days shows how long on average customers are taking to pay. It is calculated as the ending receivables balance, divided by sales for the reported period, multiplied by the number of days the sales represent. Often the number of days is 365, which represents one full year of business operations.

Inventory Days = (Ending Inventory / Cost of Goods Sold) * Number of days of cost of goods sold

Inventory days provides the number of days of selling possible before the warehouse is emptied. This metric gives a good indication of whether a company is needlessly holding onto its inventory. Holding inventory in warehouses incurs costs to the business and might also indicate if the business is holding potential cash as unsold stock, which could be better used in other operations.

Payable Days = (Ending Payables / Cost of Goods Sold) * Number of days of cost of goods sold

Payables show the average number of days the business is taking to discharge its obligations to suppliers. A high positive number indicates the company has a free source of funding and can use that cash it owes to cover other costs. However, a low or even negative number suggests the business is not meeting the payment deadlines for its obligations.

Working Capital Days = Receivable Days + Inventory Days – Payable Days

This ratio measures how efficiently a company is able to convert its working capital into revenue. The higher the number of days, the longer it takes for that company to convert to revenue. It shows how long cash is tied up in the companies working capital.

Ending balance sheet amounts are commonly the basis for forecasting forward and are used in the formulas shown above. Some analysts (typically credit analysts) use an average balance figure for the period instead. However, the ending balance is preferred for forecasting.

Operating Cash Cycle

The operating cash cycle uses the three ratios to measure the efficiency of a business by showing how much time is needed between the acquisition of raw materials and the receipt of cash from customers. It is like an OWC calculation but expressed in days rather than monetary amounts, so inventory and receivable days (the assets) are added and payable days (the liability) is subtracted. The net product is the number of days for which funding is tied up or released.

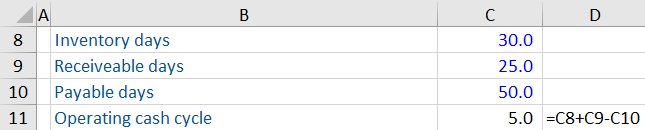

Consider a business with the following information:

For this business, on average it takes 30 days from the acquisition of product until its delivery to customers, following a sale. The customers then take 25 days to pay after receipt of the goods. Meanwhile, it takes the business 50 days to pay its suppliers for the product. It, therefore, takes 55 days (30 + 25) between buying product and receiving cash from customers. We can, therefore, say 50 days of this cycle is funded for free by the supplier leaving 5 days funding shortfall. This funding must come from traditional sources on which interest will be charged. It can be deduced that the shorter the cash cycle is, the more efficient the business.