Last Twelve Months (LTM)

January 15, 2021

What is Last Twelve Months?

Last Twelve Months (LTM) calculations help analysts to produce rolling yearly income statements. LTM preparation involves using the latest available company figures by taking information from the 10K and the latest 10Q reports.

For trading comparables analysis, it is important to select an appropriate value driver in order to best understand the business and its valuation. The historic (or trailing) value driver should be the latest valuable. The LTM calculated figures provide this.

If calculating EV/EBIT for a comparable in October 2020, and you have the annual earnings figures up until the 31st December 2019. You also have their quarterly figures for Q1, Q2 & Q3 2020 from the company’s published quarterly statements (Form 10-Qs). Using the data from these quarterly statements, you can create the comparable company’s income statement until the most recent quarter (Q3).

Key Learning Points

- Last twelve months calculations provide the most recent income statement data from the latest available company filings

- The data is calculated using information from the 10Q (or quarterly reports) and the 10K reports

- In trading comps, it is important to use the latest available information for accurate valuation

- A value driver is a factor that drives a company’s growth and performance; using LTM figures allows for the latest available earnings figures to be used in analysis

LTM Explained

LTM calculations use the yearly and quarterly reports to produce the latest available data. The process can be better understood with an example.

Example 1

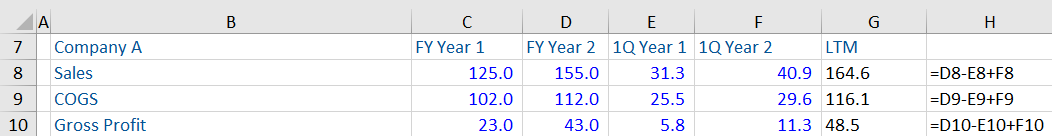

Based on the following company data, calculate the last 12 months figures till 1Q Year 2.

The data above is a section of the income statement. The LTM figures can be calculated using the following formula:

12 months data from the latest Annual Report (10K)

(Less) 3 months prior period data from the prior period’s quarterly report (10-Q)

(Add) 3 months current period data from the latest quarterly report (10-Q)

The example above requires subtracting the figures of 1Q Year 1 from the full-year data of FY Year 2 and adding the information for 1Q Year 2.

Based on the formula above, here is the LTM data:

Example 2

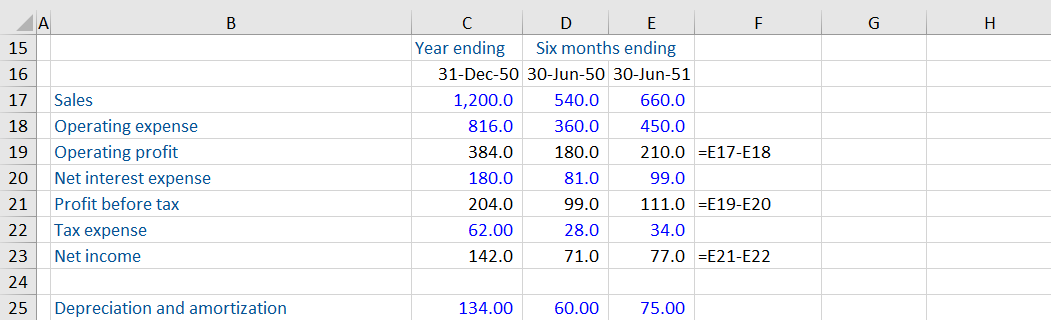

Based on the below information, calculate the LTM EBIT and EBITDA for this company.

First, you calculate the EBIT and EBITDA for the respective periods. EBIT is the recurring operating profit of the company and in this example is equal to the operating profit. To calculate EBITDA, you add depreciation and amortization to the EBIT. This removes the impact of depreciation and amortization expenses. This process needs to be completed for each period.

The LTM figures can now be calculated by adding the most recent 6 month figures to yearly figures and then subtracting the old 6 month figures. This produces an LTM EBIT of 414.0 and LTM EBITDA of 563.0.

Companies are often valued based on Enterprise Value multiples which require an earnings number before finance costs. Both these figures are common value drivers for EV multiples. The LTM figures now reflect the latest data available for increased accuracy.