Taxation – Permanent Differences

December 17, 2020

What are Permanent Differences?

Permanent differences refer to situations where an item’s tax accounting treatment is fundamentally different from its treatment in the financial statements. The difference arises due to items attracting a different tax rate. These are different to temporary differences, where the treatment is the same but the timing is different.

Permanent differences are one reason for the divergence between the effective tax rate (ETR) and the marginal tax rate (MTR). Under both US GAAP and IFRS, businesses are required to explain the main reasons for the divergence between the ETR and the MTR. This may be shown in absolute money amounts or percentage terms. An example of this is shown below:

Johnson and Johnson – Extract from footnote 8

The ETR and the MTR are two commonly used metrics in the context of taxation. ETR is the tax rate observed in the income statement and is calculated as the reported tax expense in the income statement divided by the reported earnings before tax.. The MTR is the tax rate on the next dollar of earnings and is typically the statutory tax rate in the relevant country.

In the example above, since J&J is a US company, the MTR is the US statutory rate plus any local taxes (21.0% + 0.8% = 21.8%). The ETR (15.0%) reflects the tax rate observed in the income statement.

Key Learning Points

- Permanent differences refer to situations where an item’s tax accounting treatment is fundamentally different from its treatment in the financial statements

- Permanent differences are one of the reasons for the divergence between the effective tax rate (ETR) and the marginal tax rate (MTR)

- Under both US GAAP and IFRS, businesses are required to provide an explanation of the main reasons for the divergence between the ETR and the MTR

- Possible reasons for permanent differences include non-deductible expenses, tax benefits on employment incentives and the impact of international operation

Permanent Differences Explained

Here are a few reasons for permanent differences between the ETR and MTR.

Non-deductibles

Non-deductibles are expenses which are not allowed to be deducted when calculating the profits subject to taxation. Examples of non-deductibles are staff entertainment, fines, and penalties. While normal expenses may receive tax relief at the company’s marginal tax rate, reducing the amount of tax a company has to pay, non-deductibles do not receive any relief.

For example, if a particular expense, such as fines, is not allowed in the tax calculation, it will reduce the company’s costs for tax purposes. Consequently, it will increase the company’s taxable profits and its tax expense.

This creates a problem as the tax paid, based on the company’s tax calculation, differs from the company’s accounting tax expense. To deal with this, the tax expense in the company’s income statement is adjusted to match the expense calculated by the tax authorities. This leads to a difference between the ETR and the MTR.

Tax Benefits on Employment Incentives

Consider an example where a business has a factory in an area with a lower tax rate than the statutory tax rate to incentivize employment in that area. Suppose the business has profit before tax of 100,000. Of this amount, 20,000 is taxed at 10% due to the employment incentives. The remainder is taxed at the MTR of 30%. The company’s tax expense is 26,000 (20,000 * 10% + 80,000 * 30%), resulting in an ETR of 26% (26,000/100,000). The ETR is somewhat lower than the MTR (30%) due to the impact of the incentives.

The Impact of International Operations

If a company has operations in jurisdictions with statutory tax rates different than in the parent country, it can lead to differences between ETR and MTR. For example, income earned in jurisdictions with lower statutory rates than the parent country can result in a lower ETR for the group overall.

Calculating Permanent Differences

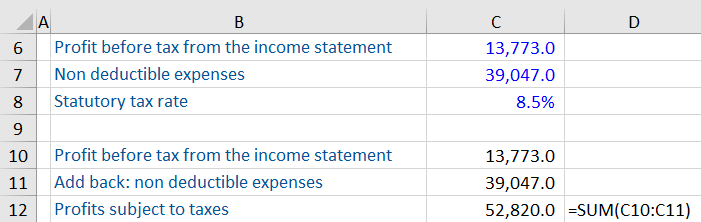

Here is some tax-related information about a company. We have been asked to calculate the tax liability, the tax expense, and the ETR.

The profit before tax (13,773) is calculated after including non-deductible expenses of 39,047. These expenses have been incurred by the company, so do need to be included in the income statement, but the tax rules do not allow these expenses to be deducted in calculating the tax liability of the company. The statutory tax rate (and therefore MTR) is 8.5%.

To calculate the taxes that are payable, we need to adjust the company’s profits before tax from their income statement by adding the non-deductible expenses.

Based on this information, we can calculate the tax liability, the tax expense, and the ETR. The tax liability shows up on the balance sheet, and the tax expense shows up on the income statement.

As you can see, the ETR of 32.6% is substantially higher than the MTR (8.5%). This is caused by the non-deductible expense not being allowed for tax purposes, resulting in a significantly higher value for the profits subject to tax when compared to the profit before tax in the income statement. This is a permanent difference between the tax authority treatment and the accounting treatment of this expense, since it will never be allowed to be shown as a deduction in the calculation of the company’s tax liability.