Operating Leases

December 7, 2020

What are Operating Leases?

A lease is a contract for the use of an asset over a specified term. The lessee (the person who gets to use the asset) does not have legal title to the asset but could potentially have rights and obligations that are very similar to ownership. A lease spreads the cash cost of the asset over its life rather than being an upfront cash outflow as would be the case with an asset purchase.

Leases, which are similar to asset purchases in terms of the rights and obligations that the lessee has, are called capital or finance leases. Under US GAAP, if a lease does not qualify as a capital lease, then it is called an operating lease, which is similar to the rental of an asset and in which the lessee has no rights or obligations of ownership.

Key Learning Points

- Operating leases are those whose economic substance is the same as renting an asset

- All leased assets now need to be shown in the balance sheet as both an asset and as a liability, reflecting the obligation to make future lease payments

- Lease accounting rules changed under both IFRS and US GAAP with implementation of the new rules from the start of 2019

- Under IFRS, almost all leases are now accounted for as finance leases were previously

- US GAAP operating leases and finance leases will have different treatments in the income statement. However, both capital and operating leases require an asset and liability to be shown on the balance sheet.

Operating Lease Accounting

From 2019, new lease accounting standards came into effect, both under IFRS and US GAAP. Under IFRS, the classification of operating and finance leases has been amended. As a result, most leases will be accounted for as finance leases.

US GAAP still has a distinction between finance/capital leases and operating leases. Both capital and operating leases are reported on the balance sheet as a liability and an asset, but the income statement impact is different.

The accounting treatment for operating leases under US GAAP is:

- Operating leases are shown as an asset on the balance sheet, valued as the present value of the lease payments (not the market value of the asset)

- The lease liability is shown on the balance sheet (similarly, the present value of the lease payments)

- The income statement shows an expense of the cash payment to the lessor within operational expenses.

- No interest expense or depreciation is shown in the income statement

Example: Operating Lease Accounting (US GAAP)

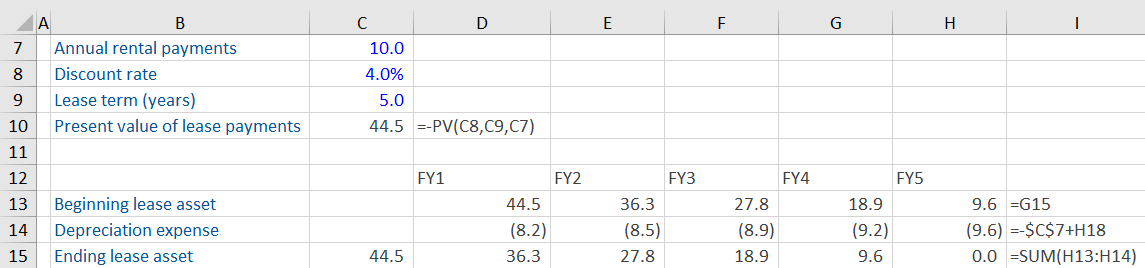

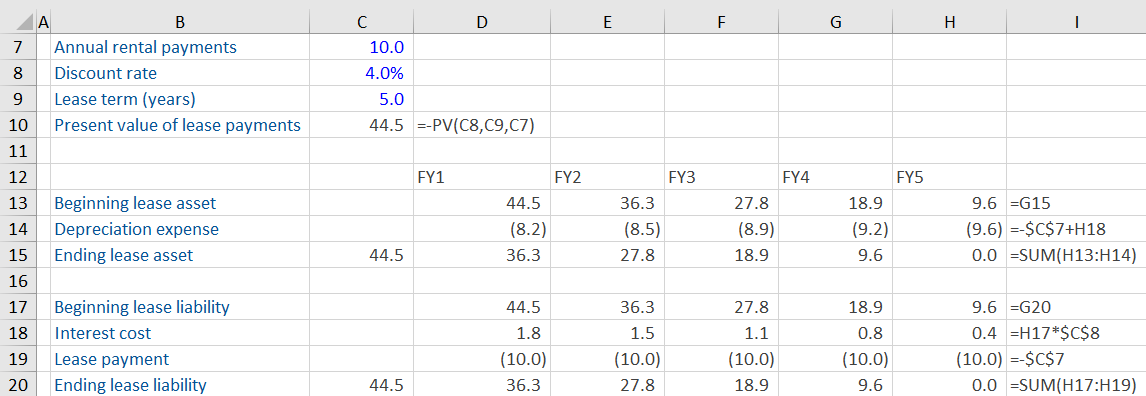

A company enters into the following lease contract and has a 4.0% cost of borrowing. We are asked to calculate the lease asset, lease liability and lease expense throughout the lease term under US GAAP. All figures are in millions.

The present value of the lease payments is calculated the size of the asset and liability recorded when the lease was entered into. Using the PV function in excel, a discount rate of 4.0% and annual payments of 10.0 gives the PV of lease payments as 44.5.

Under US GAAP, this lease could be categorized as either an operating or a finance lease. The accounting treatment of this lease as an operating lease under US GAAP will be as follows:

Lease Asset

The present value of the lease payment has already been calculated. The lease is recorded in the balance sheet at this amount.

Depreciation is just set to be equal to the change in the liability (shown below) so that the asset and liability fall at the same rate. This needs to be done because the accrued interest and the depreciation expense may not always equal the rent expense or cash payment. This way, the ending balance of the leased asset matches that of the lease liability.

Lease Liability

The accounting for the lease liability is the same as finance/capital leases. In the beginning, the liability is the same as the asset value. The interest cost is calculated by multiplying the beginning balance with the implicit interest rate (discount rate). Annual cash payment is deducted, resulting in an ending balance of 36.3. In year 2, the beginning balance is the ending balance of year 1. A similar accounting treatment is followed in years 2 and years 3. At the end of year 3, the liability’s ending balance is 0.

Income Statement

The rental expense is expensed either under COGS or SG&A in the income statement. The total lease payment is divided by the number of years, meaning that the cash flows will match the income statement expense. An exception to this is where the lease payments increase over time. In such cases, the expense in the income statement will not match the cash outflows each year.

How do Leases Affect Valuation?

In some sectors, where leasing is widely used, the inconsistency between the accounting treatment of operating leases and capital leases can cause problems with trading comparables analysis, specifically when comparing the EV/EBITDA multiple. To deal with these problems for valuation purposes, the EBITDA of companies which use operating leases should be adjusted to reflect what EBITDA would have been if the company had used finance leases.

To recap from our earlier blog on , enterprise value (EV) is calculated as equity value + debt – cash. As part of this conversion, the lease liability needs to be included in debt as the leased asset is already included in the enterprise value of the business. For the EV/EBTIDA multiple, the EBITDA must not include an expense for the interest and depreciation resulting from the lease.