Post-Employment Benefits

December 2, 2020

What are Post-Employment Benefits?

Pensions and OPEBs (other post-employment benefits) are arrangements between employers and employees which aim to provide benefits to retired employees as a reward for their service during their working career. Post-employment benefits are also known as post-retirement benefits.

Most post-employment plans consist of a deferred salary but also may include other benefits like healthcare (particularly in the US). There are many types of pension schemes but all fall into two categories: defined contribution and defined benefit.

When it comes to financial reporting, the accounting for post-employment benefits impacts a company’s financial statements in the following ways:

- An expense reducing net income in the income statement

- A liability or an asset may be recognized on the balance sheet, depending on the nature of the pension plan

Depending on the nature of a pension or OPEB liabilities , post-employment benefits (specifically, defined benefit plans) can also have a significant impact on the valuation of a business.

Key Learning Points

- Pensions and OPEBs (other post-employment benefits) are arrangements between employers and employees which aim to provide benefits to retired employees as a reward for their service during their working career

- The most common post-employment benefit plans are defined contribution plans

- Defined contribution plans are expensed as they are earned, and the plan participant bears the investment risk

- For defined benefit plans, the sponsoring employer sets the level of the post-employment benefits to be paid in the future, and therefore takes on the investment risk

- Plans can be unfunded or funded, but funded are most common

Defined Contribution and Defined Benefit Schemes

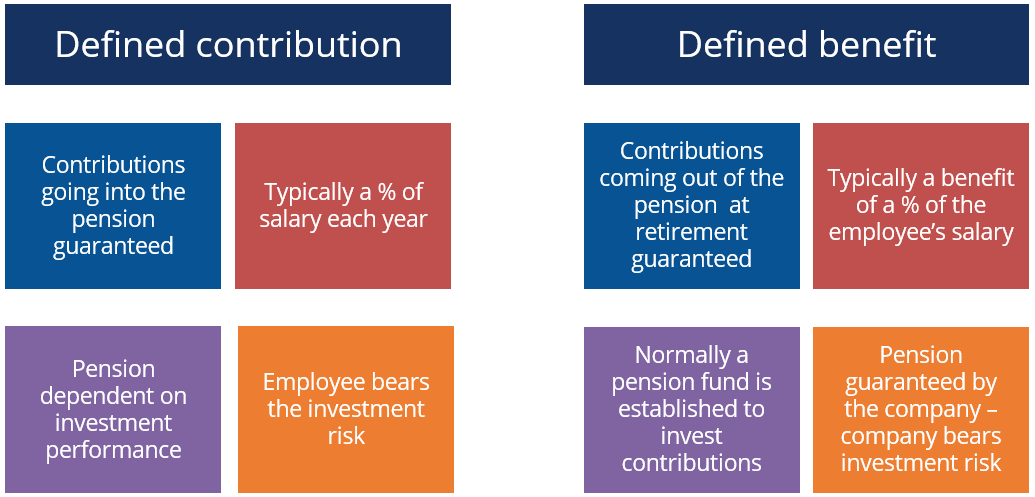

A key difference between defined contribution and defined benefit schemes is who bears the investment risk (the employer or the employee). The differences between the two types are shown below:

Defined Contribution

These are by far the most common plans offered by a sponsoring employer to its employees. In a defined contribution plans, the contributions going into the pension plan (by the employer and the employee) are pre-determined, typically, as a percentage of an employee’s salary. The money is invested in a pension fund either with or without employee involvement. The pension payment received by the employee depends on the investment performance of the pension fund. The employee bears the investment risk since the plan sponsor does not guarantee the pension the employee receives, only the contributions into the pension plan. If the plan generates good performance, the employee will benefit from higher pension payments, and vice versa. There is no potential liability to the company other than the contributions, which are treated as an operating expense in the income statement. There is pension asset or liability in balance sheet for defined contribution plans.

Defined Benefit Plans

In defined benefit plans, the payments made from the pension plan during retirement are set by the employer. By pre-determining the eventual post-employment benefit, the employer takes on the investment risk, since if the assets within the pension plan perform poorly, the employer may have to make additional contributions. Typically, the benefit is calculated as a percentage of an employee’s final salary and the number of years they have worked for the firm. A pension fund is established to invest the contribution of the employer and the employee. Even if there are not enough assets in the pension fund, the company has defined the benefit to be paid to the employees, and as such have an obligation to make additional contributions to the fund to make up any shortfall. These plans are less common, and the provisions within these plans is being reduced by many employers.

Funded and Unfunded Plans

Pension plans also vary by funding status (whether funded fully or partially). They can be of two types:

- Funded plans

- Unfunded plans

Funded Plans

If assets have been set aside to meet the future pension obligations for defined benefit plan, the plan is referred to as a funded plan. A separate entity (normally a trust fund) is responsible for managing and administering the plan. Cash payments are made into the plan by the sponsor to meet the future obligations. The fund pays pensions to the employees in retirement.

The present value of the obligations that the pension plan has to make in pension payment are the liabilities of the pension plan. The assets on the pension plans balance sheet consist of contributions made to the fund and return generated on those contributions. . If these assets and liabilities are equal, the plan is said to be fully funded.

If a defined benefit plan is underfunded, which means it has liabilities greater than its assets, the size of the deficit (the difference between the assets and liabilities) must be shown as a liability on the sponsoring company’s balance sheet.

In the UK and US, it is mandatory for defined benefit plans to be funded; this means any contributions that the plan’s actuary determines are necessary must be made to a separate funding vehicle..

Unfunded Plans

If assets have not been set aside into a separate legal entity to meet future defined benefit pension payments, then the plan is referred to as being unfunded. Cash payments are not made now to meet future payments. The result of this is that the obligation to pay pensions is an obligation on the company and as such the present value of the expected pension payments is shown in the long-term liabilities in the sponsor’s balance sheet. There is no separate pool of assets for the pension plan.. Japan and Germany are examples of countries where funding for defined benefit pension plans is not required.

All defined contribution plans are funded and held off balance sheet. Defined benefit plans may be funded for unfunded, however, most benefit plans are funded.

Download our workout on Post-employment benefits to improve your understanding of defined contribution and defined benefit plans.