Leverage Ratios

November 24, 2020

What are Leverage Ratios?

Leverage ratios typically either measure the proportion of a company’s debt relative to another financial item (for example equity or total financing), or the company’s ability to support interest payments or principal repayments on its outstanding debt. They are often compared to an industry benchmark as an indicator of how levered (or geared) the company is.

Leverage ratios are used by lenders, valuation analysts, management, and investors to guide their decision-making process. They are used to make comparisons across industry peers and historical data of the same company. Depending on their role, they can use the findings of this benchmarking exercise to decide whether it is prudent to invest in, or provide debt financing to a company, or alternatively, whether the business has the capacity to take on new debt.

Leverage ratios also help lenders control risk in relation to loan agreements. For example, lenders may set maximum limits for leverage ratios in their credit agreements. If borrowers breach those limits, lenders may put restrictions on certain actions such as paying dividends or raising more debt. In addition, banks are required to comply with a leverage ratio, which is designed to prevent excessive build-up of balance sheet risk in the banking system.

Key Learning Points

- Leverage ratios are used to measure a company’s leverage and its ability to support debt financing

- Leverage ratios are used by lenders, valuation analysts, management, and investors to guide their decision-making process

- Key leverage ratios are, debt-to-EBITDA ratio, debt-to-equity ratio, debt-to-capital ratio, and interest coverage ratio

- Acceptable levels of leverage ratios are driven by the characteristics of the business, industry, and sentiment in the credit markets

Leverage Ratios – Explained

There are four widely used metrics related to leverage:

Net Debt

Net debt is the debt owed by a company, net of any highly liquid financial assets.

Net debt = Total interest-bearing liabilities – Highly liquid financial assets

Using net debt to assess a company’s leverage position makes sense where it has a lot of surplus short-term cash and cash equivalents, which it could use to repay debt.

Debt to EBITDA Ratio

The debt to EBITDA ratio analyses the relationship between a company’s debt and its earnings before the impact of depreciation and amortization. It is used to assess a company’s ability to service its debt. A low debt to EBITDA indicates the company’s debt is low in proportion to its earnings, indicating a greater certainty of repayment. Suppose a credit analyst is comparing two companies in the same industry with debt to EBITDA ratios of 10x and 4x respectively. For a prospective lender or an investor, the company with debt at 4 times has lower default risk than a company with debt at 10 times its earnings.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is used as a measure of earnings when comparing debt with earnings. EBITDA is often used as a proxy for cash available to service debt. However, caution should be taken as even in the least asset-intensive business EBITDA is not a complete proxy for cash flow. Net debt is often substituted for debt to provide a more accurate assessment of the debt owed. A company may have high total debt with adequate cash and liquid assets to pay it off, resulting in a low net debt. In such scenarios, using total debt may mislead stakeholders through a higher leverage ratio.

Debt to EBITDA = Debt / EBITDA.

Debt to Equity & Debt to Capital Ratio

The debt to equity and debt to capital ratios examine the proportion of debt financing in the capital structure of a business. The debt to equity ratio calculates debt as a percentage of equity financing. The debt to capital (debt plus equity) ratio calculates debt as a percentage of total capital.

The formulas are expressed as:

Debt to equity ratio = Debt / Equity

Debt to capital ratio = Debt / (Debt + Equity)

Both ratios highlight the impact of the leverage effect. In good economic times, a high proportion of debt relative to equity or total capital means return to equity holders are relatively higher than returns generated by the business’s operations. However, in bad economic climates, a higher proportion of debt also means the losses of equity holders are relatively higher.

Interest Coverage Ratio

The interest coverage ratio, also known as interest cover, measures a company’s ability to service interest payments. Interest cover is calculated as EBITDA divided by interest expense and can be interpreted as the number of times that company could have paid (or covered) the current period’s interest expense from the current period’s profits.

Highly geared companies often incur high-interest payments, and it is important to understand whether a company is able to meet these payments. By comparing a company’s earnings with its current interest burden, lenders can assess whether the company’s earnings can support additional interest payments. However, it is important that EBITDA is clearly defined by the lender to ensure it fairly represents a company’s cash flows (assuming there are no discrepancies between a company’s earnings and its cash flows).

Leverage Ratios Example

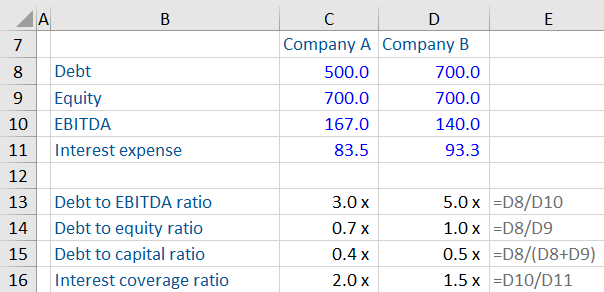

Here is some financial data from two companies to understand the calculations and interpretation of leverage ratios. Both companies operate in the same industry. They have different capital structures and thus different interest expenses.

These items can be found in the income statement and balance sheet but may require some adjustment. For example, debt is a total of various debt items such as commercial paper (current liability) and long-term debt (non-current liability). EBITDA needs to be calculated by adding depreciation and amortization (typically most easily identified from the cash flow statement) to EBIT or operating income in the income statement. For equity, if the company is listed it is better to use the market value and not the book value of equity shown in the balance sheet. The book value is used for accounting purposes and could differ significantly from the market value. Using market values for calculating leverage ratios provides a more accurate representation of the company’s financial position.

Company A has a lower debt to EBITDA ratio. Based on this information, as of this date, Company A seems better placed to service its debt obligations. Company A also has a lower debt to equity ratio (debt is 0.71 times equity) and a lower debt to capital ratio (debt is 0.4 times capital) against Company B.

Company A also has a higher interest cover as compared to Company A. Assuming EBITDA is a close proxy for cash flows for both companies, Company A has a lower interest burden relative to its earnings.

Leverage ratios should be checked against industry benchmarks. Acceptable levels of leverage ratios vary by business, industry, and the credit sentiment in the market.