Treasury Stock

November 23, 2020

What is Treasury Stock?

Treasury stock is an account within a company’s financial statements to account for any repurchases of its own stock that the company has made. A company may buy back their own shares from the market if they see them as undervalued or to return excess capital to shareholders as an alternative to paying a dividend.

The account is found in the balance sheet as well as the statement of changes in shareholders’ equity.

Key Learning Points

- Treasury stock is an account used for representing the number of shares repurchased from shareholders

- Additionally, treasury stock also includes shares surrendered to the company in connection with employee stock options and restricted stock units (RSUs)

- Treasury stock is a contra equity account or an account within the shareholder’s equity account with a negative balance

- Treasury stock does not have voting rights, is not considered for dividends or in the calculation of earnings per share (EPS)

- There are two methods of accounting for treasury stock: 1) cost method, and 2) par method. The cost method is more commonly used

Difference Between Treasury Stock and Other Equity Accounts

Shareholders are owners of a company and reap the financial rewards but also bear the risk. Their rewards stem from an increase in the share price (capital appreciation) and profits distributed in the form of dividends. The vast majority of shareholders are common shareholders. Here are the key differences between treasury stock and common stock.

| Common Stock | Treasury Stock | |

| Right to vote on certain company decisions | Yes | No |

| Considered for the distribution of dividends | Yes | No |

| Considered while calculating Earnings Per Share (EPS) | Yes | No |

| Rights over the residual value of assets in case of liquidation | Yes | No |

Methods of Accounting for Treasury Stock

When companies issue stocks, these are recorded in the equity section of the balance sheet, within the common stock and additional paid-in capital reserves. Treasury stock is a contra equity account, which means it will have a negative balance. If a company carries out a share buyback, there are two ways of accounting for treasury stock:

- Cost Method

- Par value method

The key difference between the two methods is the treatment of gains or losses arising from the share repurchase.

Finding Treasury Stock in the Financial Statements

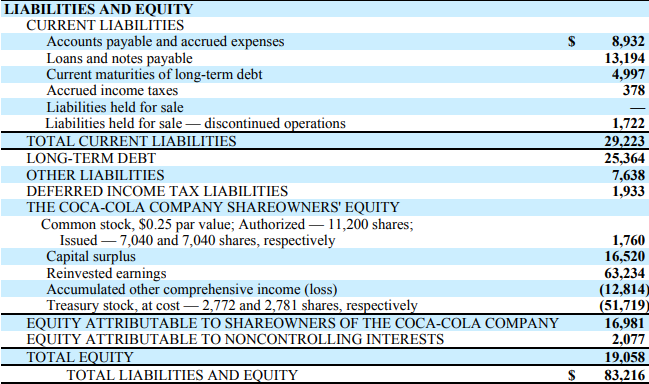

You can find information on treasury stock in the consolidated balance sheet of a company. Treasury stock can be found in the Liabilities and Equity section as part of shareowners’ equity.

Here is an excerpt from the balance sheet of The Coca Cola Company.

Here, treasury stock has a negative balance and reduces total equity. The company uses the “at cost” method of accounting for treasury stock.

Additionally, you can find details of treasury stock in the consolidated statements of shareholders’ equity. The statement gives investors more transparency about the changes in equity accounts and reports the business activities that contribute to the movement in the value of shareholders’ equity.

The section has details on treasury stock at the beginning and at the end of the year. It also includes the details of any stock issuance during the year.