Controlling Stake

November 13, 2020

What is a Controlling Stake?

A controlling stake is when a company Has the ability to control the operating and financial policies of the company, which is often achieved by holding over 50% of the voting rights. The acquiring company is said to achieve control and have a significant impact on key business decisions. Achieving control is beneficial for various reasons such as increasing market share, reducing costs (synergies), acquiring new talent or technology, etc.

If a company acquires a controlling stake in another company, under accounting rules, it must consolidate 100% of the assets, liabilities, revenues and expenses.

Key Learning Points

- A controlling stake is when one company owns more than 50% of the outstanding shares in another company and makes the key decisions for the business

- Determining when control has been achieved is more nuanced than owning more than 50% of the shares outstanding, and both IFRS and US GAAP have extensive guidelines on what constitutes control

- The acquirer of a controlling stake in another company must consolidate 100% of the assets and liabilities, revenues and expenses with its accounts

- A non-controlling interest (NCI) represents a shareholder or shareholder group that owns a minority stake in a company that is controlled by another company

Accounting for a Controlling Stake

Control Achieved – 100% Acquisitions

When a parent purchases 100% of the shares outstanding of a company, it becomes the sole shareholder in each subsidiary. The shareholders of the parent are the shareholders of a family of corporations, via subsidiary relationships. These subsidiaries are always included in full, in the consolidated financial statements of the parent. Below highlights how the transaction is accounted.

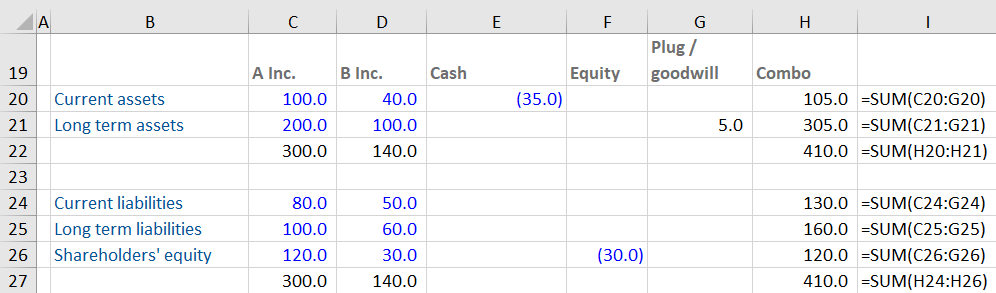

A Inc. buys all the equity of B Inc. for 35 in an all-cash deal. Here is how the consolidated balance sheet of A Inc. would look like.

All the assets and liabilities of both A Inc. and B Inc are added. Cash is deducted to account for the financing of the deal. And the difference between B Inc.’s equity and cash paid of 5.0 is shown as goodwill. Goodwill is not really a plug number but is calculated comparing the price paid minus the fair value of the net assets acquired: 35 – (140-50-60) = 5.

Control Achieved – Non-Controlling Interest Created

An NCI is created when a group achieves control (over 50% of votes), but has not bought 100%. Another way to end up with an NCI is to IPO a minority stake in a subsidiary.. The parent or group is not the sole shareholder in the subsidiary corporation. The subsidiary accounts are consolidated 100% with the groups.

The consolidated balance sheet for a group reflects all assets and liabilities the group controls (say for simplicity’s sake this means to own over 50% of the shares). This results in the balance sheet of the group being partially funded by investors that retain non-controlling stakes. The consolidated balance sheet will have an NCI on the financing side to reflect this.

In the income statement, all the revenues and expenses are of all companies in the group are consolidated to create the group accounts. The net income attributable to NCIs is then deducted in order to arrive at net income to shareholders of the group, the starting point for EPS calculations.

Below shows the income statement for Walt Disney. 530m of the net income is attributable to NCIs and is deducted to give net income available to shareholders of the group at 8,240m.

The Walt Disney Company – Extract from Income Statement 2019

Controlling Stake & Valuation

In valuation, analysts use the DCF with synergies and transaction comparables method for valuing a controlling stake. Transaction comparables include the premium paid to achieve control. The value derived from transaction comparables is likely to be higher than that from trading comparables. Here are some key factors involved in valuing a controlling stake.

Control Premium

Acquirers pay a significant acquisition or control premium on top of the target’s share price to achieve a controlling stake. Control is valuable because it gives an acquirer the ability to set the strategy of the target, make operational improvements, extract cost savings, and ultimately, create value.

Synergies

For the purposes of financial analysis, the value creation is driven by and analyzed through synergies. It is synergies that make the combined entity greater than the sum of the individual parts. Estimation of synergies is a key part of M&A analysis. Understanding potential synergies provide key insights in negotiating the control premium.

Financial Feasibility

Favorable market conditions in the capital markets are crucial to an acquirer’s ability to gain a controlling stake. For large deals, acquirer’s might have to raise billions of dollars from public and/or private markets. The capital could be in the form of either debt or equity or both. Investor’s appetite for debt and equity financing will dictate the financial feasibility of the transaction.

Precedent Transactions

The transaction comparables method uses prices paid for similar businesses in the acquisition of a controlling stake. Market prices are used as the starting point and are closer to the market’s view of the valuation. The selection of the peer group of comparables involves a high degree of judgement and can significantly influence the valuation.