Notes Payable

November 12, 2020

What is Notes Payable?

Notes payable is a written promissory note stipulating that a borrower has obtained a specific amount of funds from a lender and promises to pay back the funds with interest over a specific period. The lender may set a fixed interest rate or a prime rate, which varies in conjunction with the rate charged to the lender’s best customers.

Notes payable appears on the balance sheet under current liabilities if the payback period is within 12 months or under long-term liabilities if it is due for longer than 12 months.

To reduce the risk of defaults, lenders may ask for collateral such as company or personal property. In some cases, the lender will impose restrictive covenants in the notes payable to prevent the borrower from paying dividends to investors while the loan is outstanding. If the borrower breaches the covenant, the lender has the right to call the loan.

Key Learning Points

- Notes payable is a written promissory note which defines the terms of a borrowed amount of money between the borrower and lender with the promise to pay back the funds over a specific period (with interest)

- It is reported on the balance sheet as a current liability and represents an external source of finance

- It is common for lenders to ask for collateral in the form of personal property or some other asset to reduce risk of default

- Accounts payable represents a company’s obligation to pay the short-term debt it owes to suppliers for goods or services purchased to run its operations, where they have received an invoice

Example

Kellogg Company:

Kellogg Company – Extract from Balance Sheet at December 28, 2019

Financial Instruments

The carrying values of the Company’s short-term items, including cash, cash equivalents, accounts receivable, accounts payable, notes payable and current maturities of long-term debt approximate fair value. The fair value of the Company’s long-term debt, which are level 2 liabilities, is calculated based on broker quotes. The fair value and carrying value of the Company’s long-term debt was $7.8 billion and $7.2 billion, respectively, as of December 28, 2019.

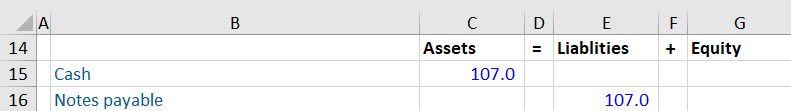

Kellogg Company recorded the notes payable when received as follows:

Notes Payable Vs. Accounts Payable

Notes and accounts payable indicate a company’s financial obligation to settle its debt. Both appear under liabilities on the balance sheet, but there are a few differences.

The key difference is that accounts payable is an amount that a company owes to its suppliers for the purchase of goods or services where it has received an invoice. Notes payable is a written promise that specifies an amount that the borrower must pay back on a specific date for money borrowed. Specific payment terms are laid out in notes payable such as a maturity period.

Accounts payable is always a short-term obligation to the business, whereas notes payable can be a long-term liability. Companies can convert accounts payables into notes payables, but they cannot convert notes payable into accounts payable.

Companies who take out notes payable have to pay it back with interest, but they are not liable for interest under accounts payable. Some suppliers will charge the company penalties if they pay late.