Operating Working Capital (OWC)

October 27, 2020

What is Operating Working Capital?

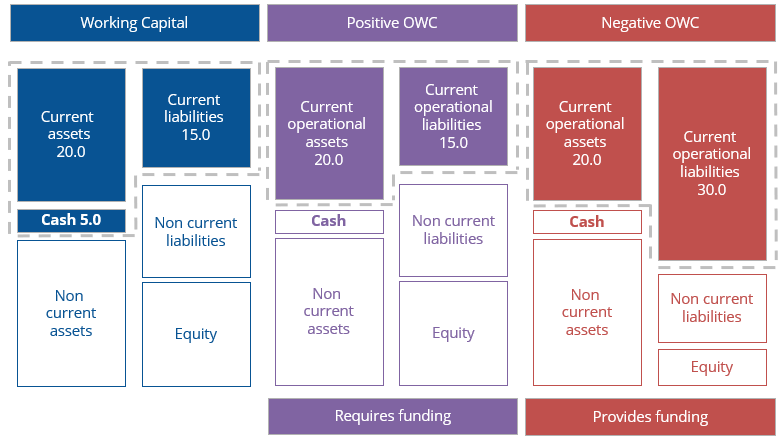

Cash flow is fundamental for successful businesses and not having cash readily available could result in a loss of opportunities and failure to meet financial obligations. Working capital is current assets less current liabilities and is often expressed as a percentage of sales in order to compare businesses within a sector. The measure attempts to assess short term liquidity of a business and determine how well the company can cover the payment of its forthcoming liabilities. It provides an indication of how much cash a business has tied up in current assets and whether it can cover its short-term obligations.

If an industry has inventory which cannot be easily liquidated then often an amended version of the metric is calculated. This uses current assets less inventory instead of current assets and is called the acid test or quick ratio.

Operating working capital is defined as operating current assets less operating current liabilities. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing (financial). Cash and other financial assets are typically excluded from operating current assets and debt is normally excluded from operating current liabilities.

Operating Working Capital (OWC) = Operating Current Assets – Operating Current Liabilities

Key Learning Points

- Working capital is a measure of liquidity and calculated as current assets less current liabilities

- Operating working capital focuses on the operating short term assets and liabilities required to run a businesses’ operations and is calculated as operating current assets less operating current liabilities

- Positive OWC indicates cash is tied up in the operations of the business and short term funding is required. Negative OWC indicates the business has access to a “free” source of short term funding

- OWC should be carefully used as a sole operating measure and is best used in conjunction with other operating ratios to better understand the business and the industry it operates in

Operational Assets

Operational assets are defined as resources used to generate revenues which are essential for ongoing business operations. Inventories, accounts receivable, and prepaid assets are all short-term operational assets. Often cash is excluded because it is not necessary in the day-to-day running of a business. However, sometimes it may be classed as operational if a business requires cash, such as a travel shop for currency exchange. However, most businesses purchase and sell goods/services on credit and do not require cash to generate revenues.

Operational Liabilities

Operational liabilities are classified as non-interest bearing liabilities and result from the operational activities of the business. Accounts payable, salaries payable, and most accrued liabilities are all operational. They are not interest-bearing (in the normal course of business) and, therefore, often referred to as providing “free funding” to the business.

Free Funding

Often analysts view a business as an operational entity that requires funding. This represents the “sources and uses” view of the balance sheet. Short-term assets are required to operate a business, and require funding, but how are these assets funded? Some funding is “free” since under normal circumstances it is not interest bearing. A great example of free funding is accounts payable, whereas debt is interest bearing. OWC distinguishes between interest bearing financial items and non-interest bearing operational items.

Understanding Operating Working Capital

A business with positive OWC, where short-term operating assets are greater than short-term operating liabilities, require short-term funding. Cash is “tied up” in the business creating the funding requirement. Businesses with negative OWC, where short-term operating liabilities are greater than short-term operating assets, get extra “free funding”.

A highly positive working capital will mean the company is more than capable of meeting its short-term obligations and can put the surplus of funds to invest. Likewise, a negative figure means the company may have difficulty meeting its short-term obligations in the future.

Problems with OWC?

You need to be careful when using OWC as an operational measure as it is very dependent on the industry and how the company operates. Many analysts use the metric to compare two or more businesses of different sizes by representing the number as a percentage of sales. This makes the metric more comparable as the absolute number calculated before only provides just that, a number. The larger the business, the larger the number, due to the scale of their operations rather than their efficiency. It is meaningless to compare companies of different sectors due to the difference in the characteristics of the industry.