Calendarization

October 20, 2020

What is Calendarization?

When comparing comparable companies, it is important to compare their financial data across the same earnings period. This ensures data is consistent for the time period. However, companies often have different accounting year end dates, making comparisons less meaningful as they relate to different reporting periods. Calendarization is used in this instance and involves time weighting both reported and forecast information to help analysts make more meaningful conclusions.

Key Learning Points

- Calendarization is the process of time time weighting both reported and forecasted income statement line items to make comparisons between similar companies with different financial year end dates more meaningful

- Forward data is often calendarized to a consistent period end

- Historic data is typically normalized to remove the impact of non-recurring items

- Calendarization allows higher accuracy when calculating valuation multiples if a business has recently acquired a controlling stake in another company; this is known as calculating the pro-forma numbers

Calendarization Explained

Suppose you’re valuing a company that has an October year-end. And you’re using a comparable company that has a 31st December year-end. You want the comparable company’s sales and other data for the period between November 2019 to October 2020.

Based on the information below, calculate calendarized sales and EBITDA from November year 1 to October Year 2.

In this example, you’ll take 2/12ths (or 16.67%) of data from the comparable company’s actual figures and the remaining 10/12ths (or 83.33%) from the comparable company’s forecast figures. Here’s how the calculations would look like:

Based on the calculations, you can use 583.3 as sales and 475 as EBITDA for the comparable company for the period November 2019 to October 2020. The two companies numbers are now directly comparable. Multiples play an essential role in valuing companies. Multiples are calculated by comparing a value (such as enterprise value, equity value,) with a value driver (such as EBIT, EPS, etc) to calculate the valuation multiple. However, if the earnings value drivers aren’t comparable you must use calendarization.

Pro Forma Valuation Adjustments for Mergers and Acquisitions

Another use for calendarization is in valuation after mergers and acquisitions. Let us understand this with an example of calculating an EV/EBIT multiple after a company has made an acquisition. Suppose the company purchased a business at the beginning of October last year, and the acquiring company files accounts with a 31st December year-end. The Enterprise Value of the consolidated (post-acquisition) company on 31st December will include 100% of the target company’s assets and liabilities. However, the EBIT of the target company in the denominator of the multiple will only include the target’s earnings between October to December, as acquisitions are only consolidated from the deal date onwards.

To get an accurate EV/EBIT multiple for the consolidated company, both the numerator and denominator need to reflect 100% of the target company. Calendarization helps in calculating the pro forma numbers in such scenarios.

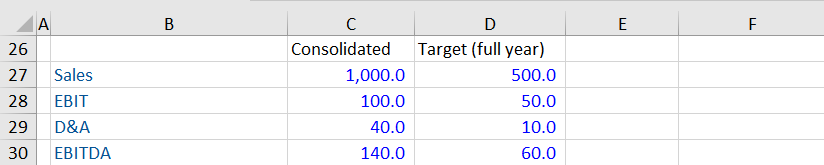

Here’s the data available for the two companies:

The consolidated year-end numbers will already include 25% of the target co.’s full-year numbers. You need to add the remaining 75% of the target company’s numbers to get pro forma numbers for the full year.

Here’s how you can calculate the pro forma numbers for the entire year.

If you calculate the EV/EBIT ratio for this company using 137.5 in the denominator, your multiples will be comparable with other companies which haven’t made acquisitions.