Cash Flow from Operations (CFO)

October 19, 2020

What is Cash Flow from Operations?

Otherwise known as the cash flow from operating activities, operating cash flow converts net income to cash income by adding back non-cash items and then taking the change in the balances of operating assets and liabilities.

It is a category in a cash flow statement that reports the amount of cash a company has generated from operational activities during a specific period. Those activities are related to providing a product or a service.

Key Learning Points

- The cash flow statement measures changes in cash and cash equivalents for the period

- Operating cash flows are those produced and used by the operations of the business

- There are two methodologies to present these cash flows: direct method and indirect method

- The balance sheet is the best guide to cash flow statement production – the change in each line items must be included in the cash flow statement

- Assets have an inverse relationship with cash flow while liability and equity items have a direct cash flow relationship

- There are three categories of cash flow, operating, investing and financing flows

The Formula

Two methods are available for calculating operating cash flows: direct and indirect – both yield the same result.

Most businesses use the indirect method, which begins with net income and converts it to OCF by making adjustments to items that do not affect cash when calculating net income.

The generic formula is:

Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Operating Working Capital +/- Changes in Other Long Term Operating Assets and Operating Liabilities

Here is where you retrieve those figures:

- Use the net income figure from the income statement

- Non-cash items such as depreciation and amortization will be on the income statement

- Changes in operating working capital are on the balance sheet and derived from changes in accounts receivable, accounts payable and inventory from the previous year to the present.

Example

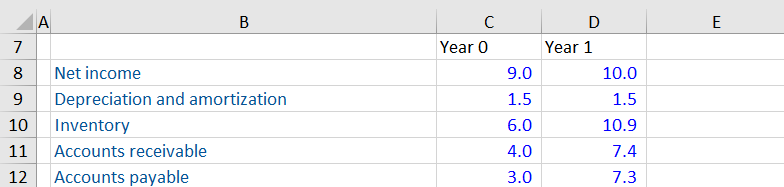

Company A compiled financial statements at year-end Year 1:

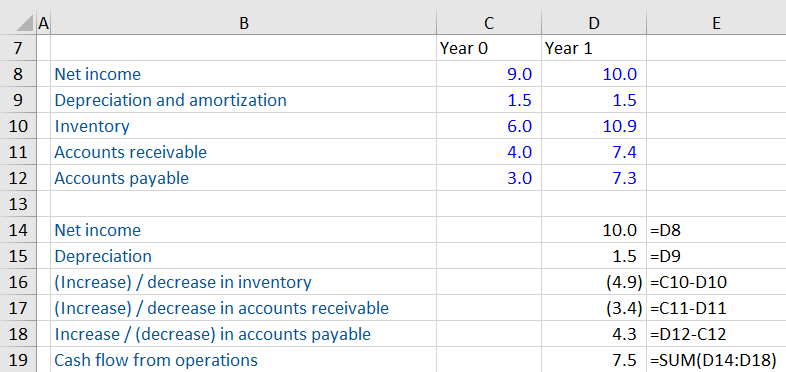

The cash flow from operating activities is built as follows:

Points to Note

- Depreciation and amortization is added back to net income as it was deducted in arriving at that figure. It is not a cash expense, however, the purchase of a non-current asset gives rise to a cash outflow and this would have been reflected under investing activities in the year of purchase.

- The increase in inventory is a deduction: if inventory rises, more inventory is purchased so cash falls.

- The increase in accounts receivable is a deduction: if receivables increase then part of the recorded sales are non-cash.

- The increase in payables is an addition: if payables increase then some costs were not made in cash.

Why is Cash Flow From Operations Important?

The cash flow from operation helps understand how much cash the day to day trading activities of the business generates. There’s less opportunity to manipulate the cash flow from operations compared to a company’s earnings.