Cash Flow from Financing Activities

October 15, 2020

What is Cash Flow from Financing Activities?

Cash flow from financing activities reports the issuance and repayment/repurchase of debt and equity financing in a specific period. In addition, it also includes dividend payments to equity holders. However, it does not include interest payments or any interest or dividends received by the corporation (interest income and expense and dividends received are included in cash flow from operations).

Examples of transactions involved in financing activities include issuance and repayment of equity, capital lease obligations, payment of dividends, as well as issuance and repayment of debt.

Key Learning Points

- The cash flow statement measures changes in cash and cash equivalents for the period

- The balance sheet is the best guide to cash flow statement production – the change in each line items must be included in the cash flow statement

- Cash flow from financing activities include any associated cash flows from the issuance or repayment of debt and equity financing

- Assets have an inverse relationship with cash flow while liability and equity items have a direct cash flow relationship

The Formula

Cash flow from financing activities = Issue / (Repurchase Equity) + Issue / (Repurchase Debt) + (Dividend Payments)

These are the most common items reported but there may be many more to include.

Remember – every balance sheet line item must be included in the cash flow statement.

The formula can be summarized as:

- Add cash inflows from issuing debt or equity

- Subtract cash outflows from the repurchase of equity or debt, and dividend payments

- There are occasionally other items included in the calculation

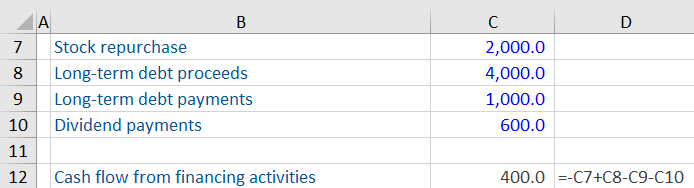

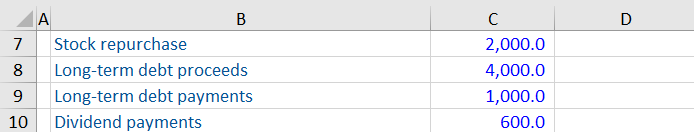

Financing Flows Example

Company A had the following transactions at year-end 20X9:

The net cash amount from the (used in) financing activities line item of the cash flow statement should reflect:

Points to Note

- Repurchase of stocks is a cash outflow

- Proceeds received from long-term debt is an inflow

- Payments for long-term debt is an outflow

- Dividend payments to shareholders is an outflow

What Items Are Included in the Calculation?

- Repayment of equity

- Issuance of equity

- Repayment of debt

- Issuance of debt

- Payment of dividends

Why is Cash Flow from Financing Important?

Cash flow from financing tells you whether the company is raising or returning capital. Typically, a company in the early stage of its life will show a positive cash flow from financing as it raises capital to grow. When a company is mature (the industry growth has slowed), we would expect to see negative cash flow from financing as the company can start to repatriate capital either by repaying debt, repurchasing equity or paying dividends.