Restricted Stock Units (RSUs)

October 9, 2020

What are Restricted Stock Units?

Restricted stock units (RSUs) are a type of equity compensation provided to employees to reward good performance and/or for completing a specified tenure with a company. Unlike regular stock options , RSUs do not have a strike price but vest upon meeting specific performance criteria ‘Performance Stock Units’ or completing a pre-specified tenure ‘Restricted Stock Units’.

Key Learning Points

- When restricted share units vest, they are included in shares outstanding as shares will have been issued to the RSU holder

- When calculating fully diluted shares outstanding, only include unvested RSUs as vested RSUs are included in the basic number of shares outstanding

- RSUs have a strike price of zero which means they are always “in the money”

- Restricted shares are shares owned by shareholders which have restrictions on them (e.g. stopping an employee trading them) and are already included in the basic shares outstanding

RSUs in Valuation

To calculate a company’s equity market value, analysts multiply the diluted number of shares outstanding by the company’s share price. The calculation of the diluted number of shares is affected by three dilutive instruments or instruments that can potentially increase the number of shares outstanding if exercised. RSUs/PSUs are one of the three dilutive instruments.

Once exercised, RSUs increase a company’s equity value because of an increase in the number of shares outstanding. RSUs do not count as outstanding shares until the restrictions get lapsed.

Calculating Net Dilution & Diluted Equity Value Resulting from RSUs

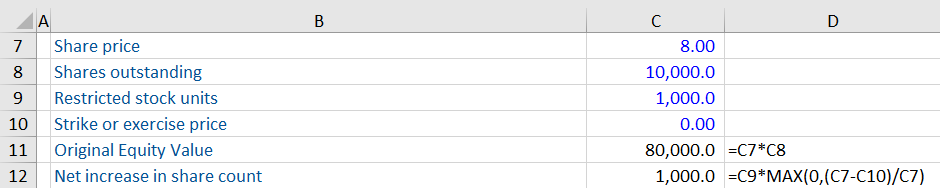

The treasury method with strike = 0 calculates the net dilution due to RSUs. Here is the formula for calculating the net dilution (just like the formula for calculating net dilution due to options).

Net dilution = Number of shares outstanding * Max [0, share price-strike price/share price]

However, unlike options, a key difference is the strike price is 0. In the case of RSUs, the strike price is the same as the share price. RSUs are not converted into shares until they reach the specified price. Once reached, all the RSUs are converted into shares.

If executives leave the firm early, the RSUs and PSUs will normally expire without being exercised. Taking the whole RSU and PSU number probably overestimates the amount which will be converted, but in the absence of any other disclosure it is the least bad situation.

Here is an example of how to calculate the diluted equity value of the company with RSUs.

First, we calculate the net dilution, or the number of shares added using the formula mentioned above:

The vesting of RSUs increases the diluted number of shares outstanding, and subsequently, increases the diluted equity value. Remember, the share price remains unaffected as it already factors in the dilutive effect of RSUs. This is publicly available information.

Disclosures about RSUs:

When companies issue RSUs, they are required to make certain disclosures. These include terms of the arrangement, impact of the compensation expense on the income statement, and the cash flow effects of the agreement.

Here is a snapshot from the 2016 Annual Report of Marriott International.

In the above example, Marriott has granted 2.8 million RSUs to certain key officers and employees. The vesting period of these units is 4 years in equal annual installments. The report also mentions how the compensation expense will be recognized in the income statement. It then mentions the conversion of RSUs into common stock upon vesting.

Restricted Stock Units vs Restricted Shares?

Restricted shares are shares that are already included in the number of outstanding shares. They are owned by shareholders already but have restrictions placed on them e.g. stopping them from being traded for a year. This may be to stop a former employee from setting up in competition to the firm.

Typically, these shares are owned by “insiders” such as employees and initial investors. There can be multiple restrictions on these shares. A common restriction is constraints on their disposal following an initial placement offering (IPO.)

While restricted shares are transferred to the owners on the grant date, RSUs act as a promise to transfer shares subject to meeting specific conditions, and they are units rather than shares so are not included in the shares outstanding.