Selling, General and Administrative Expenses (SG&A)

October 2, 2020

What is Selling, General & Administrative Expenses?

Selling, General and Administrative (SG&A) expenses is a line item on the income statement that reflects the overhead costs a company incurs to promote, deliver and sell a company’s product or service, as well as expenses involved in managing the entire company.

It won’t be directly related to sales, however, over a period of a whole year these expenses are fairly flexible. This means that when a company forecasts, it can link the SG&A expenses to sales. SG&A is not a product cost, so companies don’t assign it to the cost of goods sold or to inventory.

Some of the expenses reported under SG&A include advertising, sales commissions, marketing, rent, utilities and stationery. Those costs are not part of the manufacturing operation.

Key Learning Points

- Selling, General and Administrative expenses are reported in a company’s income statement and represent any overheads included in a company’s core operating business but not directly related to the manufacturing of a product

- When calculating EBIT (Earnings before Interest, and Taxes), the SG&A footnote should be checked for any embedded non-recurring items e.g

- The expenses are included in the calculation of operating profit, profit before tax and net income

- There are many types of expenses which are included in this line item including, advertising, marketing, rent, research and development and other administrative related expenses

- SG&A is included in the calculation of operating margin, which measures how efficiently a company converts the revenue it generates into operating profit

SG&A in the Financial Statements

Below is an extract from The Hershey Company Notes to Consolidated Financial Statements for year ended 31 December 2018:

The Hershey Company 2018 – Extract from footnotes

Key Ratios

- Operating Margin – A profitability ratio that measures how much profit a company makes per one dollar of sales. It is calculated by dividing the reported operating profit by the sales for that period. Alternatively, start with reported revenue and subtract cost of goods sold, SG&A and other overhead costs. Divide the operating income total by reported revenue and multiply it by 100 to express as a percentage.

Comparison

Below are extracts of the income statements for Coca Cola and Pepsi from their three months end quarterly 10-Q report 2019.

Coca-Cola

The Coca-Cola Company – Extract from 10-Q September 2019

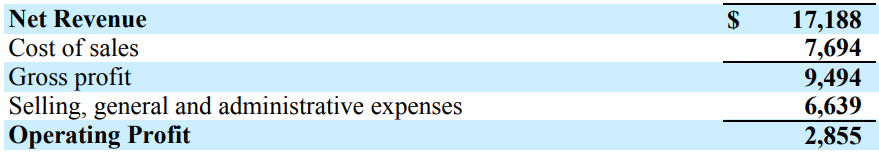

Pepsi

PepsiCo, Inc and Subsidiaries – Extract from 10-Q July 2019

Points To Note

- Numbers reported in the income statement are in millions.

- Coca Cola’s operating margin is 26.3% (2,499/9,507) x 100.

- Pepsi’s operating margin is 16.7% (2,855/17,188) x 100.

- The ratio shows that for every $1.00 sale Coke generated, it made $0.26 in operating earnings.

- The ratio shows that for every $1.00 sale Pepsi generated, it made $0.17 in operating earnings.

Why Calculate the Operating Margin?

An operating margin enables stakeholders to make comparisons of similar companies. It allows them to determine which company can better generate operating income. Pricing strategy and labor costs affect operating margin, and stakeholders can use the ratio to measure managerial flexibility and competency.