Dividend Yield

October 1, 2020

What is Dividend Yield?

Dividend yield depicts the relation of a stock’s annual dividend payout with its current stock price. It is a ratio expressed as a percentage that measures the dividends paid to shareholders relative to the market value per share.

Investors use the dividend yield ratio to measure the amount of cash flow they would receive for each dollar invested in an equity position. In other words, the dividend yield shows investors the return on their investment for a stock without capital gains.

A high dividend yield means that a company is paying a significant share of its profits as dividends. That means the company does not keep the majority portion of profits as retained earnings to grow the business through investments and acquisitions. Those types of stocks are called income stocks.

The dividend yield is affected by two things, the amount of dividends being paid out and the level of the stock price.

Key Learning Points

- Dividend yield shows the percentage of a stock’s latest closing price which was paid out to investors in the latest year

- It is calculated by dividing the annual dividend by the stock’s price

- A higher dividend yield suggests a company is paying a larger proportion of its earnings to investors rather than reinvesting the profits back into the business

- The dividend yield does not show the return an investor expects to receive on their investment and only provides information on the historic income paid. There is also no guarantee that a company will pay a dividend to their shareholders year-on-year.

- Income stocks are stocks which pay a higher dividend to holders, usually because they have limited investment opportunities to reinvest their profits (these companies have a higher dividend yield)

Formula

Dividend yield ratio is dynamic due to a company’s stock price constantly changing. When a stock price is trending upward, a company could raise its dividend payout to maintain the dividend yield. A significant increase in a stock’s price but no adjustment to dividends paid will result in a decrease in the dividend yield.

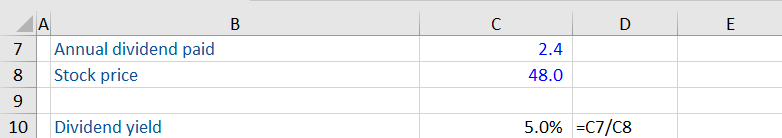

Dividend Yield Ratio

= (Annual dividend / stock price) x 100

Example

Dividend yield ratio = (2.4 / 48) x 100

=5.0%

Points to Note

- The example shows that Company A’s ratio of 5 means that it pays a significant portion of its retained earnings to shareholders as dividends.

Below is an extract from The Hershey Company Notes of Consolidated Financial Statements at December 31, 2019.

The Hershey Company – Extract from footnotes

“Dividend yields” means the sum of dividends declared for the four most recent quarterly periods, divided by the average price of our Common Stock for the comparable periods.

Importance of Dividend Yield Ratio

Often low growth companies will trade on high dividend yields. They do not have many investment opportunities, so the market expects them to pay high dividends. These are known as ‘income stocks’.

In the Oil Sector, low dividend yield stocks tend to have a lot of good investment opportunities and so the market is comfortable that they retain the earnings and reinvest them in the operating business. If the market doesn’t trust the company to make good internal investment decisions, then the stock will trade on a higher dividend yield.

Investors who want regular income, find high dividend yield stocks appealing. However, investors need to determine if the dividend is sustainable – can the company sustain that level of dividend payment or is it paying too much out of its profits?

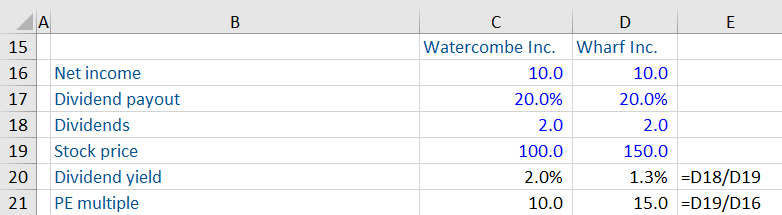

Interaction between Dividends and Valuation

Here both companies currently have the same income and dividends and the same payout ratio. However, Wharf has a much higher valuation and trades on a higher PE multiple, as the market expects Wharf to have a higher return on investment than Watercombe – its growth is more valuable than Watercombe.

However, as the market is putting a higher value on Wharf it’s trading on a lower dividend yield as the valuation is higher, reflecting higher value growth in the future.